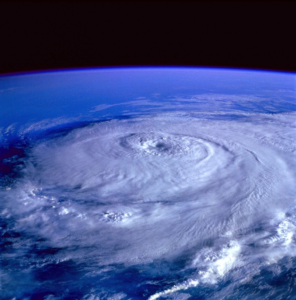

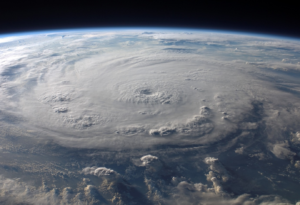

Severe storm surges, torrential downpours, and violent winds make hurricanes dangerous to you and your possessions. If your property didn’t make it out of a storm unharmed, you’re probably anxious to restore your home to its original condition.

Since hurricane claims can be a lengthy process, following the right steps and knowing the right things can help you get your home and your belongings either repaired or replaced more quickly.

Here, we discuss you can deal with hurricane damage insurance claims in Texas:

Understand how insurance covers fallen trees

Hurricanes may leave numerous fallen trees in their wake. While fallen tree insurance claims can sound messy, they’re pretty simple:

- If a fallen tree didn’t damage anything, insurance could still pay some amount to clean up the tree. However, some insurers pay nothing until your deductible is met.

- Insurance should cover the cost of repairing any damage a fallen tree causes up to your policy’s limits.

- If a tree falls into your neighbor’s yard from your property, your neighbor files a claim with their insurance company.

- If a tree falls onto your property, you file a claim with your own insurance company — it doesn’t matter whether it was your neighbor’s tree or your own tree.

Once the hurricane is named, you’re not permitted to adjust insurance coverage

Insurance companies don’t allow you to adjust your policy when a disaster is imminent.

Otherwise, most homeowners would sometimes reduce coverage and increase it when hurricanes approach.

Most insurers prevent you from adding new coverage, changing your coverage, or adjusting your policy after a hurricane is named. While you can still change your policy, changes won’t take effect until the hurricane strikes.

You may be eligible for a low-interest SBA (Small Business Administration) loan to repair or rebuild your property

When a disaster strikes, the US SBA offers low-interest loans to help people replace or repair damaged property. Plus, you don’t need to be a business owner as these loans are available to:

- Non-profit organizations

- Small businesses

- Renters

- Homeowners

The government may offer you additional compensation

Non-profit organizations and federal/state governments may offer further assistance to regions struck by the hurricane — especially after a massive disaster.

Just visit DisasterAssistance.gov, type your address, and see if you qualify for financial assistance, medical aid, or emergency housing. The money is designed to help those who injured themselves in an emergency or lost property.

Hurricane claims can have higher deductibles

Recently, insurers have silently added higher deductibles for specific types of serious weather events.

You might pay a deductible based on a percentage — usually 5% to 10% of the damage instead of paying a deductible of $1,000 to $2,000 for a hurricane.

For instance, if a hurricane causes $50,000 of damage to your home, your insurer may require a deductible of $2,500 to $5,000 to complete the claim.

You’re advised to verify your deductible requirements by checking your insurance policy. Most policies have higher deductibles for wind damage, which is probably why the deductibles of hurricane claims can be high.

Insurance covers some living expenses after a hurricane

Most homeowners are compelled to flee their homes once a hurricane strikes. If your home isn’t livable after a hurricane, your insurance should cover meals, hotels, as well as other living expenses after the loss.

A standard home insurance policy covers ALE (additional living expenses). If you need a place to stay because your home has burned down, your insurance policy covers the cost of dining out, purchasing replacement clothing, and getting a hotel, among other emergency expenses.

Don’t forget to track your expenses and receipts after a hurricane damages your home. Your insurer may reimburse you for everything.

Take photos and videos instantly after a loss

When it’s safe, take photos and videos of the hurricane’s damage instantly after the loss.

Every insurance company requires homeowners to implement basic steps to safeguard their homes after a hurricane. For instance, if safe to do so, you should put up tarps to prevent more water from entering your home. You just can’t let water pour into your home after a hurricane tore a hole in your roof and expect additional compensation for the damage that may have been prevented.

The more images and videos you have of the damage, the easier your claim will become.

Get Started with Morgan Elite Specialist Services

You can ensure that your insurance claim inspection process is as seamless as possible by having a reliable, sincere, experienced, and trustworthy public adjuster who can provide impeccable assistance during your claim.

If you’re looking for experienced public adjusting services in Texas, check out the services at Morgan Elite Specialist Services. With over 75 years of combined experience, we are well-positioned to help you deal with all your complex claim issues.

Visit their website for more information on Mass Tort Settlement, forensic accounting services, claims handling services or contact them today.